Why Copy Trading Matters

and Why It's Hard to Build

Crypto trading has always been a deeply social activity. From Discord channels sharing alpha to Twitter threads breaking down successful trades, the best trading insights spread through social connections. The most successful traders build audiences who trust their analysis and want to learn from their moves. This organic behavior has shaped how users expect to interact with trading platforms – they want to trade alongside people they trust, learn from experienced traders, and share strategies with their communities.

The rise of social trading features across major crypto platforms isn't just a trend – it reflects how people naturally trade. Users consistently gravitate toward features that let them see what their network is trading, discover new opportunities through trusted connections, and replicate successful strategies. When users find a trader whose approach resonates with them, they want an easy way to benefit from that trader's expertise.

The most engaging crypto trading experiences often start with friends. Users want to share their trades with their inner circle, celebrate wins together, and learn from each other's strategies. Friend groups create their own trading culture, developing shared insights about which tokens to watch and when to make moves. This peer-to-peer learning creates stronger traders and more active communities – but only if platforms can support these social interactions seamlessly.

But building these natural social trading experiences is surprisingly complex. Developers need sophisticated systems just to let users find and evaluate potential traders to follow, whether friends or trusted influencers. Performance tracking needs to be granular and real-time – users expect to see their friends' and favorite traders' moves as they happen, not hours later.

Users need rich social context about traders, from their previous strategies to their community engagement, all of which traditionally requires maintaining separate social profiles and complex infrastructure. The result is that most trading platforms can't deliver the seamless social experience users expect, even though that's how crypto natives naturally trade.

Tapestry Makes Copy Trading Simple

Tapestry fundamentally changes how developers can approach copy trading by providing the social infrastructure as a foundation. Instead of building complex discovery systems, developers can tap into existing follow relationships that naturally map paths to successful traders. The activity feed automatically surfaces trading patterns, while social engagement adds essential context beyond pure performance numbers.

The real-time social layer is built directly on Solana, ensuring that all social data remains consistent and immediately available. Solana's sub-second finality means users see updates instantly, while low transaction fees make it economically viable to maintain frequent social interactions and updates. This removes the need for developers to build and maintain their own real-time infrastructure.

Integration becomes straightforward through standard API calls that replace what would otherwise be complex infrastructure. Developers can access social data through familiar interfaces, and Tapestry's protocol aggregation enables cross-chain compatibility without additional development work.

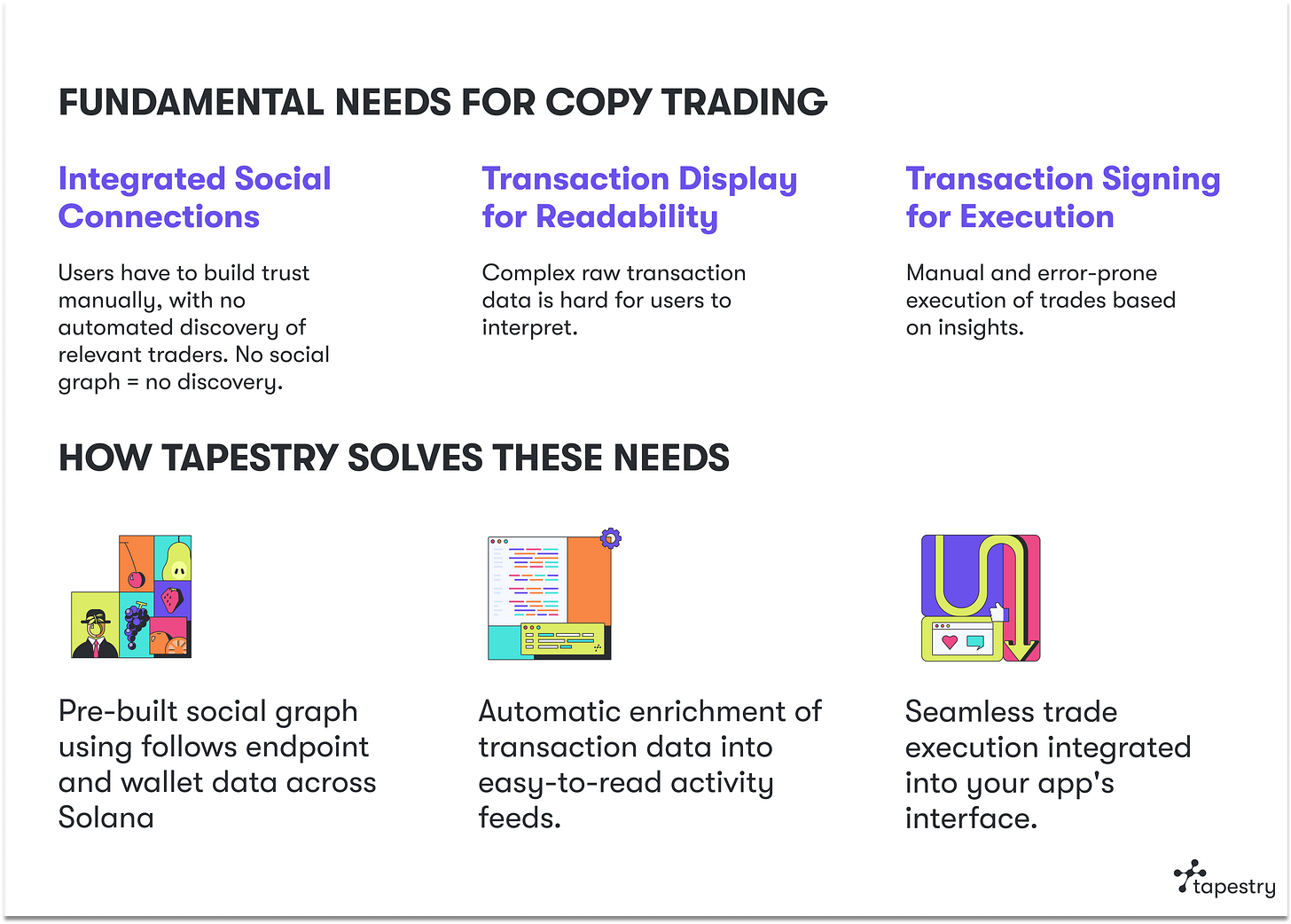

The three fundamental needs for copy trading are:

A social graph that enables discovery

Transaction display to make transactions human readable

Transaction signing to allow users to execute transactions

Tapestry’s APIs cover the first two cases, while the third is proprietary to your app. The “follows” endpoint suite enables users to build out their social graphs with just one API call. Because each user profile is owned by a wallet, the “suggested follows” endpoint traverses a given wallet’s social graph across all of Solana to find other wallets they have followed or engaged with directly, or have shown affinity for similar content. This means that building a feed of transaction suggestions is just one more API call away.

With just two calls, you can take a previously anonymous wallet and mine it for socially relevant transactions. From there, all you have to do is enable your users to copy the transactions they see in their feed.

Implementation Patterns

Different types of crypto applications can leverage Tapestry's social infrastructure in distinct ways. Analytics platforms can enhance their offering by pulling transaction data from followed addresses and displaying trades in familiar interfaces. They can add social context to raw transaction data and enable one-click trade replication, transforming static analytics into dynamic trading tools. For example:

Trading bot platforms gain the ability to build social reputation for their automated strategies. By creating transparent histories of bot behavior and enabling referral systems based on performance, they can build trust with users. The social layer makes it possible for users to evaluate bots based on both performance and community engagement before automatically mirroring their trades.

Wallets can transform into social trading hubs by surfacing trading activity from followed addresses directly in their interface. They can enable direct trade replication from the activity feed while maintaining user privacy through careful integration of social features. The social context helps users make informed decisions about which traders to follow and which trades to replicate.

DEXs can enhance their trading interface by integrating social signals directly into the trading experience. By displaying what trusted traders are doing on specific trading pairs, they can help users make more informed decisions. The social layer also enables DEXs to build community-driven features like trending pairs based on social activity and trusted trader positions, creating a more engaging and informative trading environment.

For each of these applications, implementation becomes a matter of connecting three simple pieces: integrating Tapestry's social API, building the trading execution layer, and connecting social signals to trading actions. This streamlined approach lets developers focus on creating distinctive trading features while leveraging existing social infrastructure.

The result is a more accessible crypto trading ecosystem where new users can learn from experienced traders, successful strategies can spread organically through social connections, and applications can focus on creating unique value rather than rebuilding basic social infrastructure.

The future of crypto trading is inherently social, but building these experiences has traditionally required significant infrastructure investment. Tapestry's approach of providing social infrastructure as a foundation changes this dynamic, enabling developers to focus on creating unique trading experiences rather than rebuilding basic social features.