Social Features: How Modern Apps Build Communities (Part 02)

Revolut and Clubhouse: tools that connect

In last week's analysis, we explored how Duolingo transformed language learning from a singular activity into a social experience, and how Strava turned individual fitness tracking into a community of athletes. In part 2 of this piece, we’re looking at: Revolut and Clubhouse.

Revolut and Clubhouse demonstrate how social mechanics can make traditionally solo activities—like managing money or listening to conversations—into inherently collaborative experiences. While Revolut evolved from a simple financial services app into a social payment platform, Clubhouse capitalized on social to inspire viral growth.

Both cases further reinforce how the addition of social layers can transform utilitarian tools into vibrant communities.

Revolut's Shift to Social Financial Management

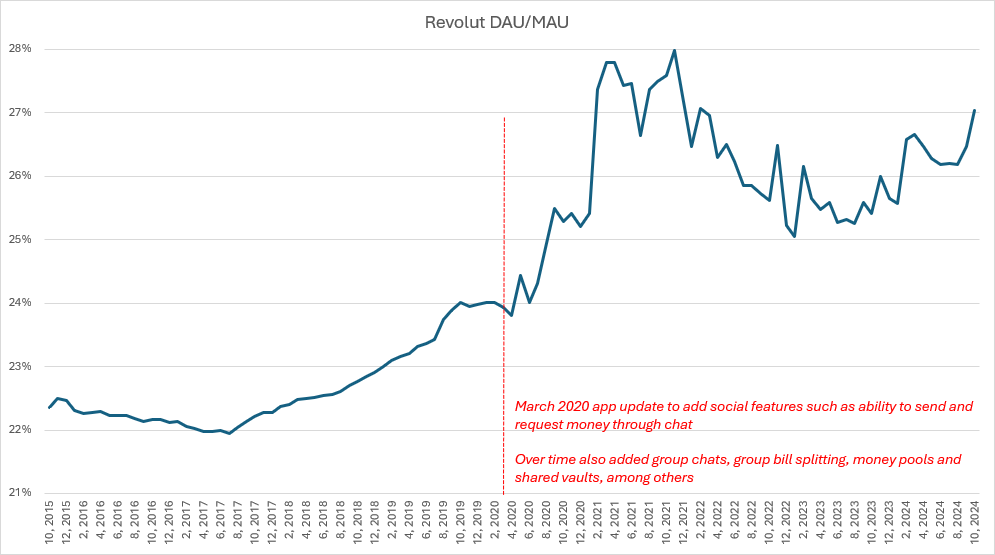

In 2020, Revolut introduced the ability to create unique usernames (or "RevTags") for simplified peer-to-peer payments. Rather than needing someone's phone number or account details, users could search for or enter a RevTag to send or request money, making the process feel similar to messaging or interacting on a social platform. They also added the ability to send and request money through chat, as well as several other features listed in the graph below.

The attached graph highlights an apparent increase in DAU/MAU, rising from 22% to nearly 30% following the release of the new social features.

Revolut then layered additional features to create a socially interactive financial management experience:

Group chats, shared vaults, bill-splitting tools, and money pools

These additions let users handle financial tasks collaboratively, making financial management feel personal and interactive. With in-app social payments and messaging, Revolut transformed from a financial tool to a daily social utility, supporting frequent user interactions and enhancing engagement.

Clubhouse: Enhancing Virality through Usernames

Usernames are more than a unique identifier—they are a tool for amplifying an app’s virality, growth, and allure. Clubhouse is a great example. Clubhouse launched in 2020, using an invite-only model that relied on exclusivity. Users needed an invite from an existing member to join. Each new user’s profile visibly linked back to the inviter, further encouraging users to share their invites across other social networks like Twitter and Instagram.

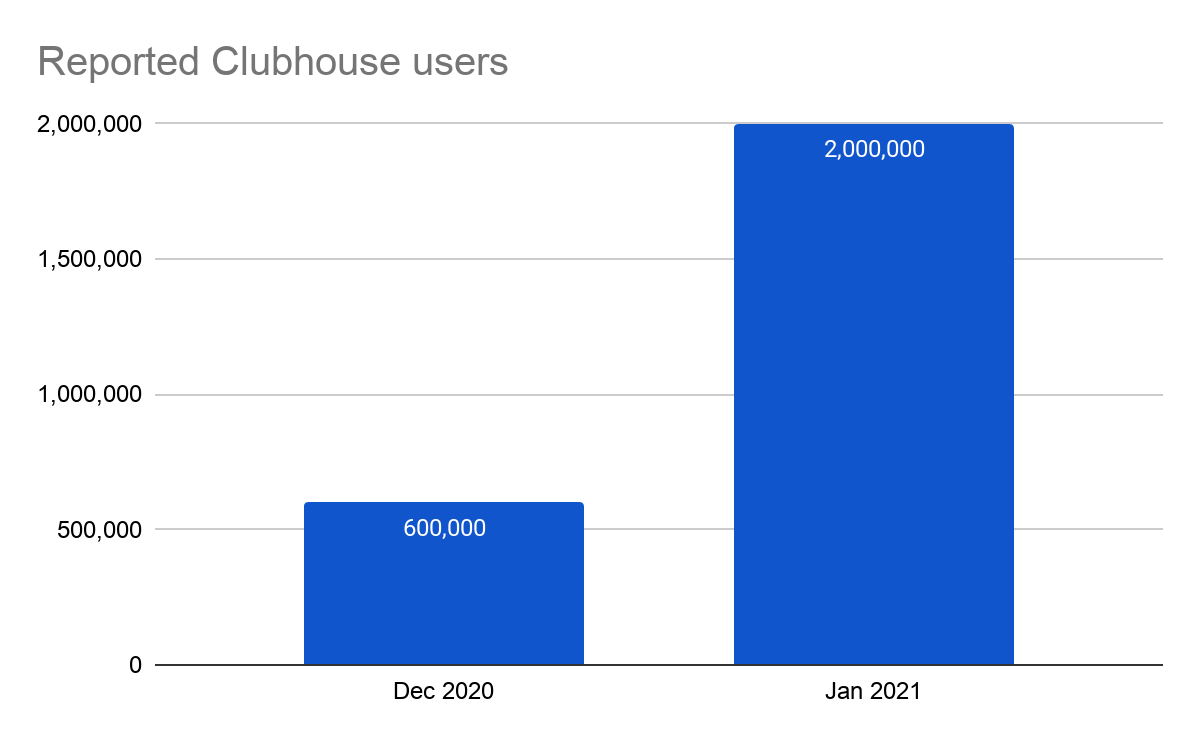

Additionally, they used usernames for their user profiles, which helped create identifiable “digital identities” that users would share, amplifying the app's reach. This growth strategy played a significant role in helping Clubhouse reach millions of users during its first couple of years.

Clubhouse launched with a bang, increasing its user base from 600,000 in January 2020 to 2,000,000 in December 2021.

This early strategy leveraged a combination of exclusivity and identity, creating a ripple effect where invites became pathways to connection and influence. By giving users a digital presence linked to those who invited them, Clubhouse encouraged organic sharing and community-driven expansion, helping the app achieve remarkable growth in its early years.

Transforming Utility Apps Through Social Identity

The success of both Revolut and Clubhouse demonstrates how social identity features can transform functional tools into thriving digital communities. RevTags and Clubhouse usernames aren't just identifiers—they're gateways to deeper platform engagement and community connection. These digital identities turn transactional experiences into social ones, whether sending money or joining audio conversations.

Social features drive growth when financial management becomes social through features like group chats and shared vaults, or when conversation platforms leverage identity-based invitations, users naturally engage more frequently and meaningfully.

This leads to:

Increased daily active usage

Enhanced viral growth through social sharing

Stronger user retention through community bonds

Starting with Social

While many platforms add social features later, both Revolut and Clubhouse show the value of prioritizing social identity early. Rather than treating it as an add-on feature, they made it core to their user experience. This approach turns routine activities—whether financial transactions or discussions—into opportunities for community building.

By integrating social features thoughtfully, platforms don't need to choose between utility and community. They can create experiences that are both functional and engaging. The key is understanding that users don't just want tools—they want places to connect, share, and belong.

With platforms like Tapestry, companies can integrate core user identities and social features seamlessly in under 20 minutes without sacrificing product focus or dev time.